An In-Depth Look at Kodal Minerals Share Price

An In-Depth Look at Kodal Minerals Share Price

Introduction

An example of the UK based exploration and development mineral firm is Kodal Minerals plc price which has attracted investors’ attention through its promising projects. In the past one year, the change and volatility is specially apparent in the mining sector and the company’s operations. The Kodal Minerals share price has moved up and down. This article will give an insight on different directions of the Kodal Minerals share movement, detailed trading range for the past year. Forecasts for the future movement of the stock and the general outlook of the terminal for any investor.

Kodal Minerals: Company Overview

Kodal Minerals, as the name implies, is a mineral exploration and development company that explores and develops deposits mainly in lithium and gold. The company’s chief asset is the Bougouni Lithium Project in southern Mali which has unconventional but promising indications of resource in recent drilling. lt; It makes the company well-placed to capture the growing demand for lithium which is used in the manufacturing of electric vehicles. Storage systems of other renewable sources of energy.

Recent Performance of Kodal Minerals Share Price

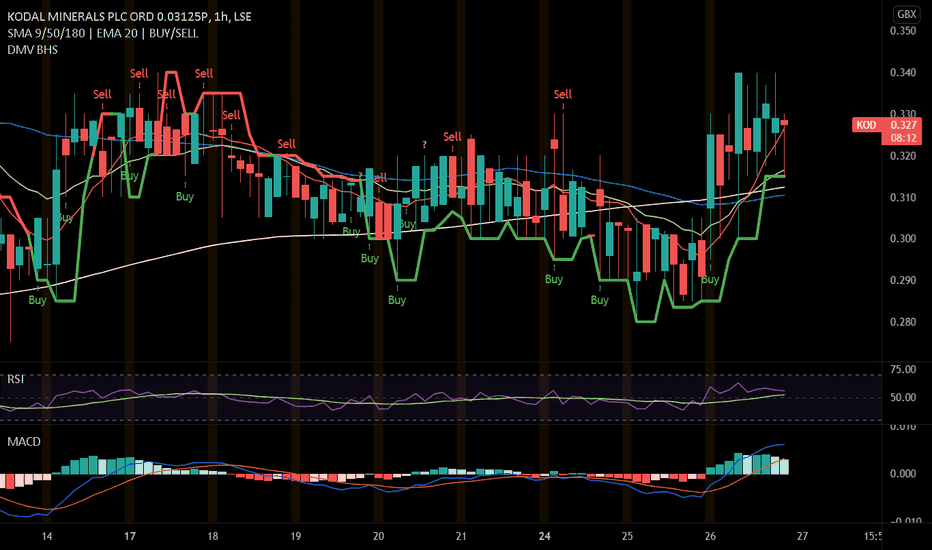

Trading Range and Recent Trends

In the period of the one year Kodal Minerals shares price operating in the stock market, the company faced considerable fluctuations of its shares’ price. The shares of the company have been fluctuating with the lowest price touching a figure of 0. From 275 to 0 was the variation of the index which showed an indication the population in New York was initially high. But reduced significantly at some point during the context. 74, that can be attributed to both broad macro market factors and other factors specific to the company.

| Metric | Value |

|---|---|

| 52-Week Range | 0.27 – 0.77 |

| Open Price (as of 12 June 2024) | 0.56 |

| Previous Close Price | 0.56 |

| Volume | 4,881,288 |

| Turnover (on book) | – |

This range indicates the speculative nature of the stock, influenced by factors such as mineral discoveries. Market demand for lithium, and geopolitical stability in the regions where Kodal operates.

Key Milestones and Market Reactions

Several key events over the past year have impacted the Kodal Minerals share price:

- Exploration Success: Positive drilling results and resource estimates from the Bougouni Lithium Project have driven share prices higher.

- Market Conditions: The activity of lithium price and demand for the company is the attribute of the global market which also influenced the changes in Kodal’s share.

- Regulatory Developments: Other events such as changes in the regulatory environment in Mali or adverse. Or favorable outcomes in its applications also have an impact on investor perception and prices for the shares.

Kodal Minerals Share Price Prediction

Analyst Predictions

The one analyst offering a 12-month price target expects the Kodal Minerals PLC share price to rise to 1.55 from its current price of 0.550. This optimistic prediction is based on several factors:

- Increased Lithium Demand: The rising requirement for Li-ion batteries sent to electric vehicles. Renewable energy is said to push up the prices of lithium.

- Project Developments: There were also some positive as improvements in the Bougouni Project. Mining other projects could unlock so much value for the company.

- Strategic Partnerships: Other opportunities include potential cooperation: Where cooperation through partnerships or joint ventures may help bring more money and know-how into projects to enhance the rate of implementation.

Market Sentiment and Investor Outlook

Generally, investors’ perception of Kodal Minerals share price has been rather optimistic though the company has often been described as a high-risk investment. In the current market, clean technologies are in high demand as they reduce emissions. This can be seen as a strategic focus on lithium puts the company in a commendable place to take off the broader market trends.

Factors Influencing Kodal Minerals Share Price

Positive Influences

- Strong Demand for Lithium: There is a growing market demand for lithium across the world due to the development of electric vehicles and energy storage solutions.

- Successful Exploration Results: Exploration activities resulted in positive outcomes in terms of increased quality of resource estimates and project viability.

- Strategic Partnerships: Partnering with larger mining companies or battery manufacturers.

Negative Influences

- Market Volatility: Market cycles, uncertainly, and volatilities such as changes in the prices of commodities and other market conditions.

- Regulatory Risks: Political and regulatory risks in operating regions like Mali.

- Operational Challenges: Potential delays or setbacks in project development.

FAQs about Kodal Minerals Share Price

1. What is the current Kodal Minerals share price?

The Kodal Minerals share price has reached 0 as of 12 June 2024 based on the latest update we came across. 56.

2. What has been the 52-week range for the Kodal Minerals plc share price?

Some of the historic pricing information includes the Kodal Minerals plc 52-week range whose lowest price was 0. 27 and 0. 77.

3. What are the key factors driving the Kodal Minerals share price prediction?

Some of the factors that may be attributed to the rising stock include the demand for lithium in the global market, the results of the exploration works in relation to the Bougouni Project, and the potential of entering into strategic partnerships.

4. How can I stay updated on the Kodal Minerals share price chat?

Some of the ways you can use are accessing the platform of the company and other financial news websites and apps that are commonly used in the business.

5. Is Kodal Minerals a good investment?

Analyzing Kodal Minerals as an investment, one must take into account such factors as mining stocks. The lithium sector, in particular, is highly risky and potentially highly rewarding at the same time. The specific factors may include the general market conditions and existing trends. The company’s specific developments in terms of the projects, and own investor’s objectives and aims.

Conclusion

The following details will provide a comprehensive outlook to the existing and potential investors. Wishing to invest in Kodal Minerals share price since the company has shifted its focus on lithium and has a number of exploration projects to look forward to. Thereby, while the stock has a history of high and dynamic fluctuations. Further growth is theoretically fully possible and promoted both by the market circumstances and the outcomes of projects. Overall, investors must always ensure they are well aware of the trends in the market and the progress of certain businesses to make good investment decisions on which business to invest in.

With the assistance of the Kodal Minerals share price chat, investors will be able to focus on the specific movements of the stocks. Avoid being uninformed about the latest changes and the tendencies that may occur in the stock market. As one learns to invest in mining, or even constructing companies. It becomes essential to forecast and analyze the factors that will impact Kodal Minerals.